In order to get your business going, efficient financial management is the key. Whether you’re a small startup or a big company, having accurate and organized financial records is super important.

To streamline your accounting processes, it’s essential to leverage the power of accounting templates while making sure that they’re accessible to everyone involved.

In this article, we’ll explore five must-have accounting templates for Google Sheets that can significantly contribute to your business’s financial success.

Income Statement Template

An income statement is the key to understanding profitability, it provides a snapshot of your business’s financial performance over a specific period.

This template typically includes revenue, expenses, and net income.

By regularly updating and analyzing your income statement, you can identify trends, pinpoint areas for improvement, and make informed decisions to boost profitability.

Get a copy of the Income Statement Template.

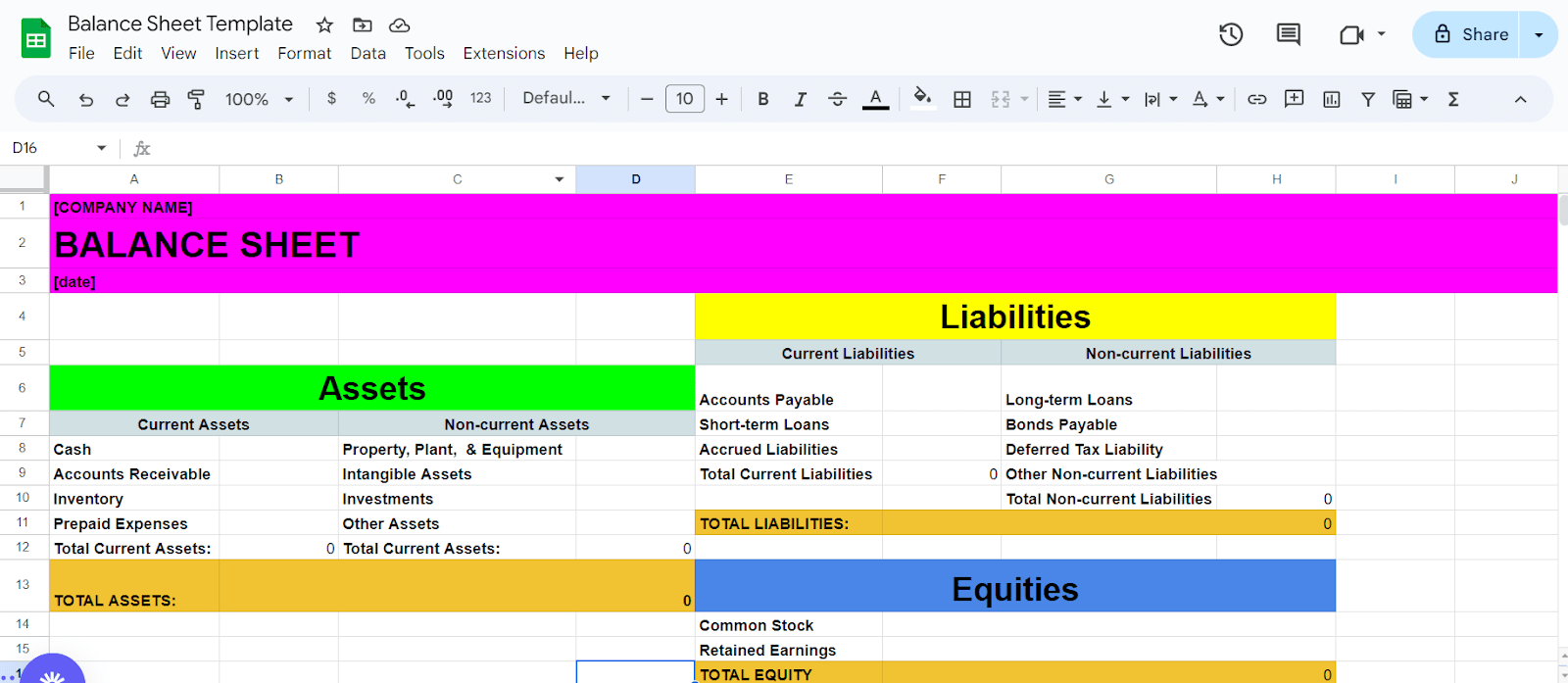

Balance Sheet Template

A fundamental accounting tool, the balance sheet shows a company’s financial position at a specific point in time.

It consists of assets, liabilities, and equity.

This template enables you to assess your business’s overall financial health, identify areas of strength, and manage liabilities effectively.

Regularly reviewing your balance sheet can also aid in strategic planning and financial forecasting.

Get a copy of the Balance Sheet Template.

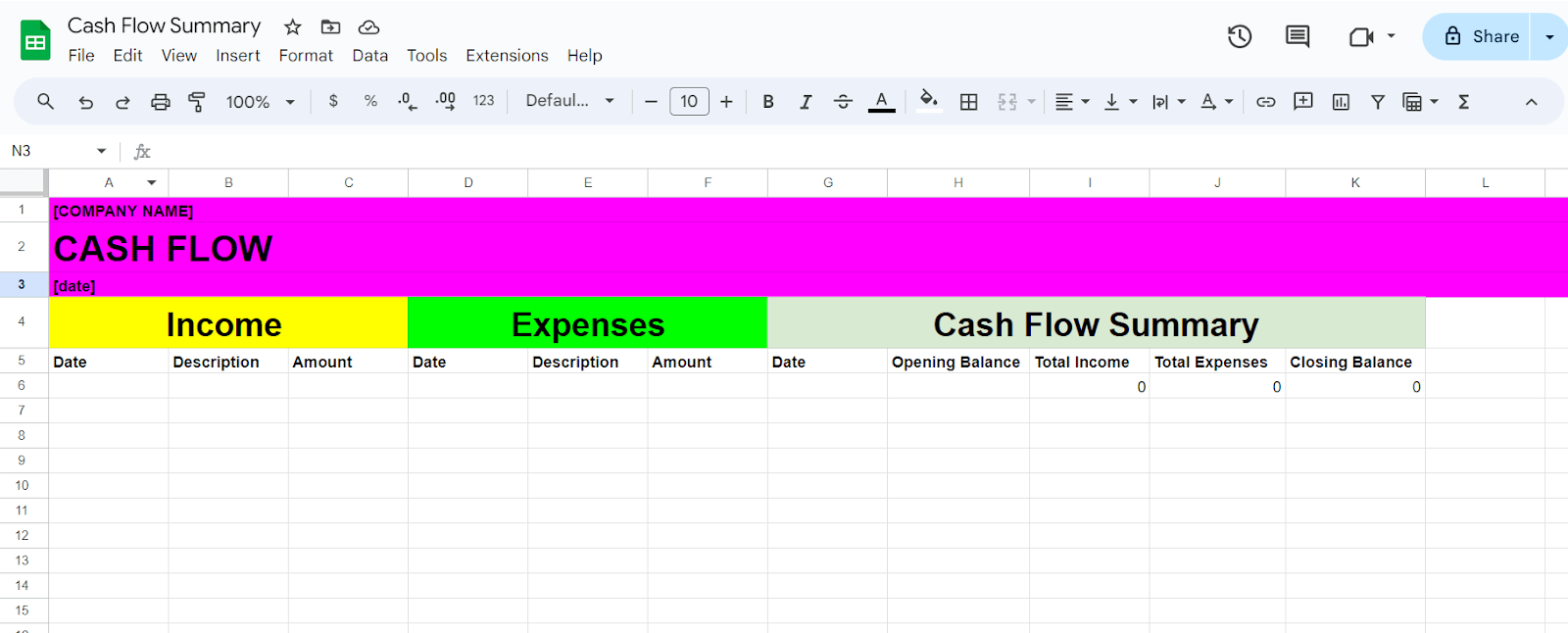

Cash Flow Statement Template

Maintaining a healthy cash flow is vital for the day-to-day operations of any business.

A cash flow statement template tracks the inflow and outflow of cash, helping you understand how well your business manages its operating, investing, and financing activities.

This template is crucial for identifying potential cash shortages, planning for capital expenditures, and ensuring your business remains financially stable in the long run.

Get a copy of the Cash Flow Template.

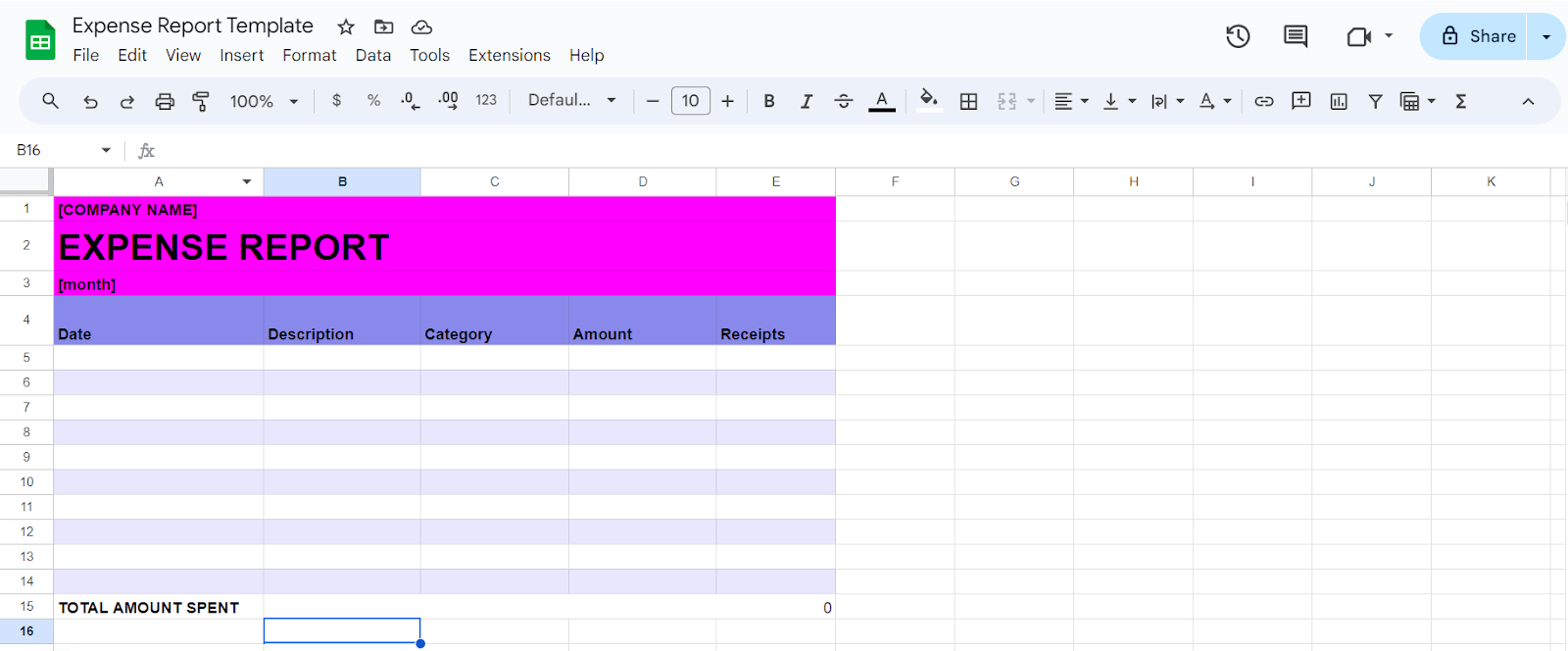

Expense Report Template

Keeping tabs on expenses is essential for controlling costs and optimizing resource allocation.

An expense report template allows you to record and categorize all business-related expenditures, making it easier to identify areas where expenses can be reduced or reallocated.

This template is especially useful for businesses looking to improve efficiency, cut unnecessary costs, and enhance overall financial performance.

Get a copy of the Expense Report Template.

Invoice Template

Timely and accurate invoicing is crucial for maintaining a healthy cash flow.

An invoice template helps you create professional and consistent invoices for your products or services.

With clear payment terms and details, you can enhance communication with clients and ensure that you receive payments on time.

Additionally, an organized invoicing system contributes to better financial planning and reduces the risk of late payments, impacting your business operations.

Get a copy of the Invoice Template.

Summary

Using these five accounting templates in your business can really help boost your financial success.

When you keep these templates up-to-date, you get important insights into how your business is doing financially. This helps you make smart decisions and positions your company for stability and growth in the long run.

Keep in mind that managing your finances well isn’t just something you have to do – it’s a smart move that helps successful businesses excel.

The Bottom Line:

One keeps you awake. The other gets work done.

A month of coffee: $150

A month of FileDrop: $19

Why not have both?