For accounting firms and finance professionals, email is still the default method to send tax returns, financial statements, or client reports. It’s familiar and seemingly convenient — but it’s also one of the least secure and least reliable ways to share sensitive financial information.

Attachments can get lost, blocked due to size limits, or forwarded to unintended recipients. Even worse, confidential client data is exposed to phishing attacks, hacking, and accidental disclosure.

There’s a smarter alternative. With FileDrop’s Secure Send feature, accountants can send tax returns, financial statements, and other sensitive documents securely, efficiently, and professionally — all without relying on email.

This step-by-step guide walks you through setup, workflow, and best practices so your firm can protect client data while streamlining document delivery.

Why Email Isn’t Secure for Financial Documents

Before using Secure Send, it’s important to understand why email is risky for financial communication:

- Lack of end-to-end security: Emails travel through servers that may be compromised.

- Forwarding risk: Recipients can unintentionally forward sensitive financial documents.

- File size limits: Most providers block attachments larger than 20–25 MB, a common issue for annual financial statements or large tax filings.

- No audit trail: You can’t verify exactly when a client received or downloaded a file.

- Inbox clutter: Important tax documents can get lost in long threads or mislabeled emails.

For accountants handling sensitive client financial data, these risks are unacceptable.

What FileDrop Secure Send Offers for Accountants

Secure Send replaces risky email attachments with a secure, branded download page. You upload files once, send a secure link, and clients can download the documents safely — without needing an account or login.

Key benefits for accountants:

- Confidentiality by design: Encrypted transfer with links that expire after first download or within 30 days.

- Large file support: Send up to 100 files per transfer, each up to 1 GB — perfect for tax returns, balance sheets, and supporting schedules.

- Professional experience: Branded download pages with your firm’s logo and instructions.

- Audit trail: See exactly when the secure message was opened and files downloaded.

- Ease of use: Clients just click the link — no passwords or technical barriers.

Step-by-Step Tutorial: Sending Tax Returns and Financial Statements Securely

Follow these detailed steps to securely send tax returns, financial statements, or other sensitive financial documents using FileDrop Secure Send.

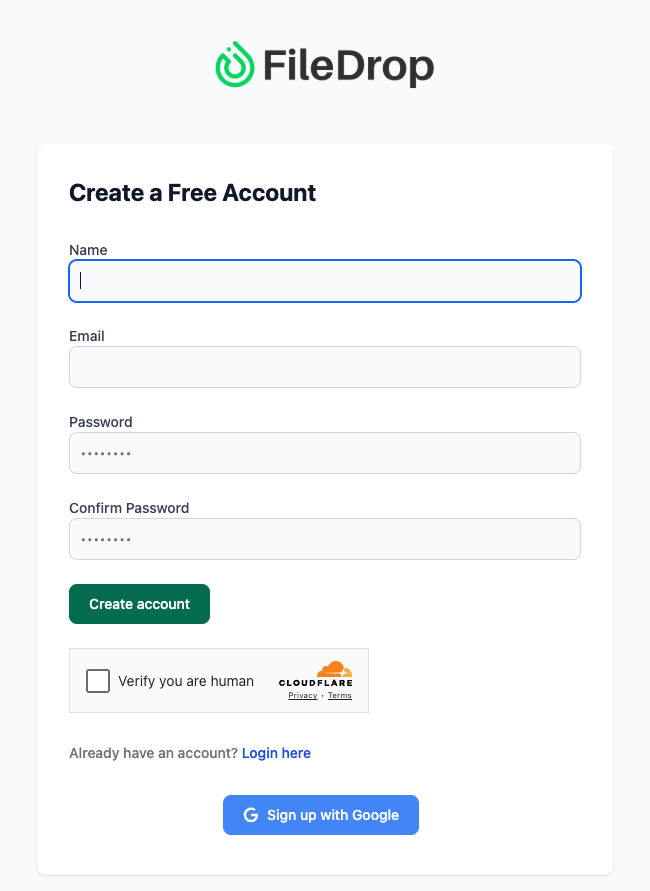

Step 1: Register for a FileDrop Account

To begin, you’ll need a FileDrop account.

- Go to FileDrop registration.

- Sign up using your work email.

- Once registered, you’ll gain access to your dashboard, which includes Secure Send and other features for secure file sharing.

Your dashboard gives you an overview of your activity, recent messages, and statistics on sent, draft, and expired messages — giving you insight into your workflow at a glance.

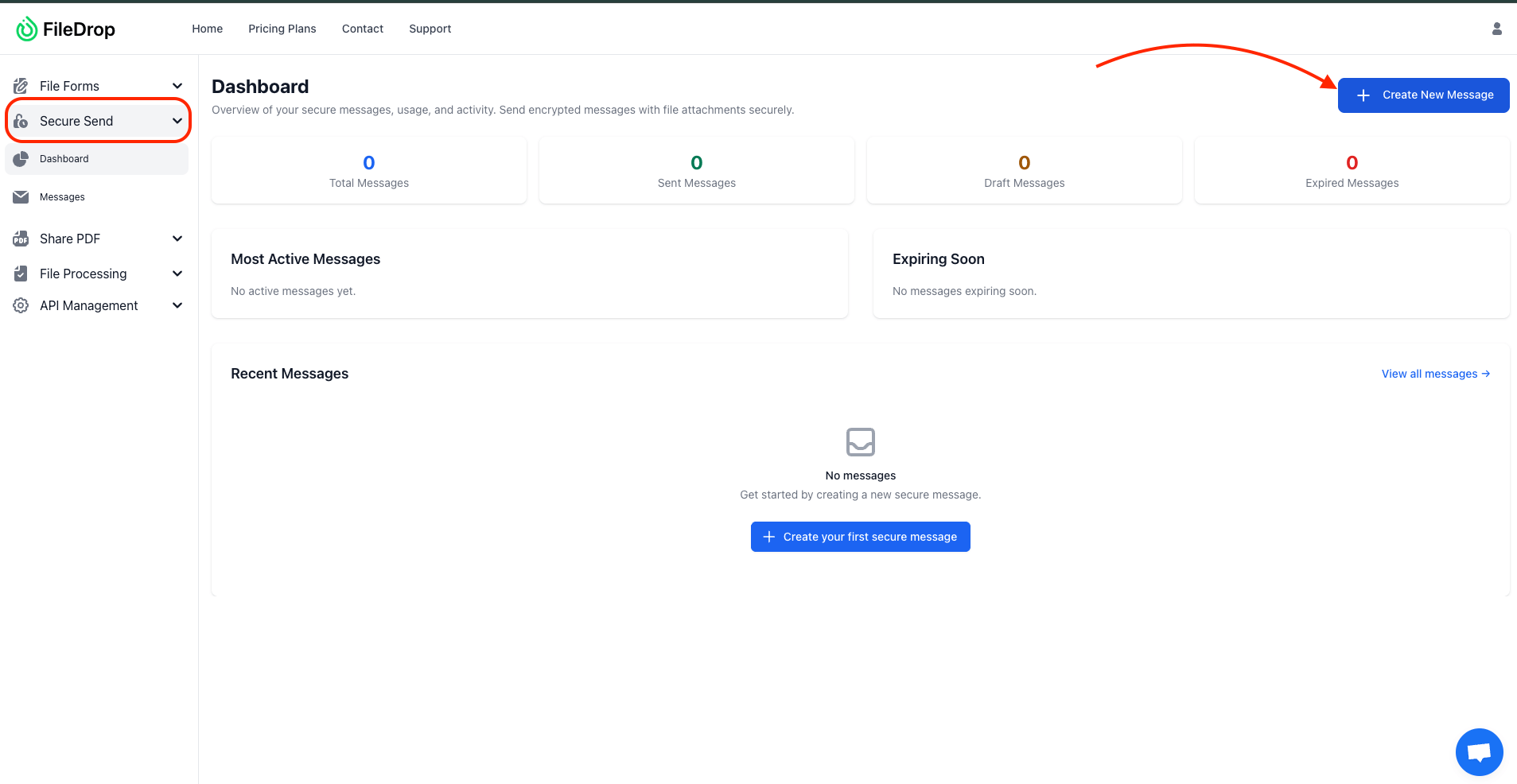

Step 2: Open Secure Send

From your dashboard, select Secure Send — this is the dedicated tool for sending encrypted files and messages.

Dashboard Overview:

- Total Messages, Sent, Draft, Expired: Quickly see the number of messages sent, saved as drafts, or expired.

- Most Active Messages: Identify messages frequently accessed by clients.

- Expiring Soon: Get reminders for messages nearing their expiration date.

- Recent Messages: Review your most recent secure sends and monitor activity.

Click Create New Message to start composing a secure message.

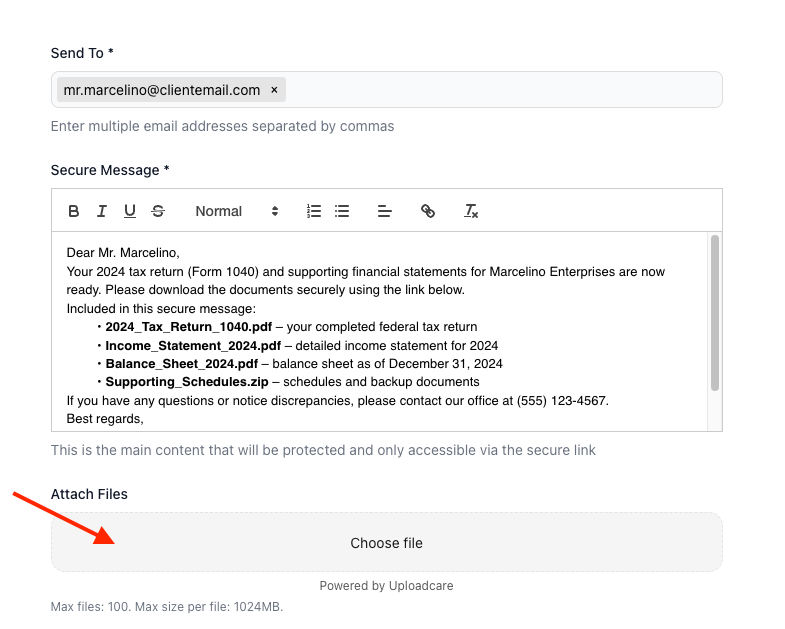

Step 3: Create a New Secure Message

The message composer allows you to configure everything your client needs to receive their financial documents safely.

Here’s what you can configure:

- Send To: Enter the client’s email address. You can add multiple recipients by separating them with commas.

- Secure Message: Write the main content of your message. This could include:

- Notes about the tax return

- Instructions for reviewing financial statements

- Reminders about deadlines or important client responsibilities

Important: All text entered here is fully encrypted and only accessible through the secure link.

- Attach Files: Upload your client’s financial documents. FileDrop supports:

- Up to 100 files per message

- Each file up to 1 GB – Perfect for sending multi-page tax returns, Excel spreadsheets, PDF statements, or ZIP files of supporting schedules.

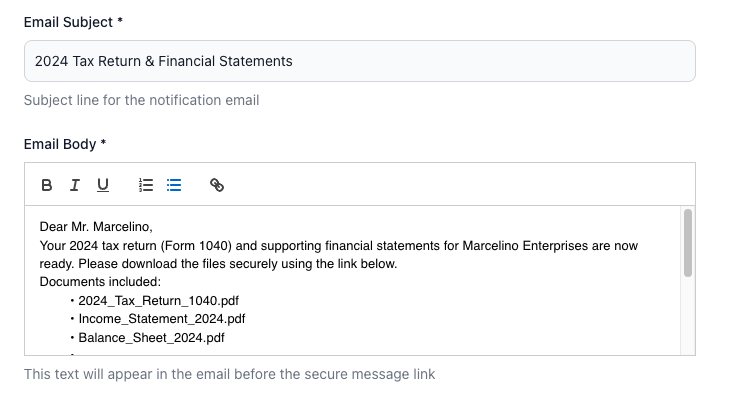

- Email Subject: Enter a subject line for the notification email your client will receive, such as: “2024 Tax Return & Financial Statements”

- Email Body: Write a short, professional message that appears in the client’s inbox before they click the secure link.

Example:

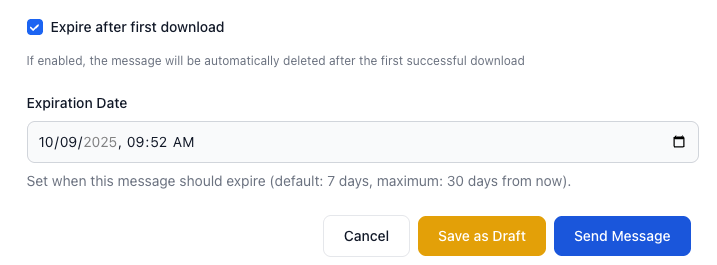

Step 4: Set Security Preferences

FileDrop gives you full control over how and when clients can access documents.

- Expire After First Download: Delete the file automatically once accessed. Ideal for highly confidential financial documents.

- Expiration Date: Set a limit (up to 30 days) for automatic expiration.

Tip: Use both settings together for maximum security on sensitive tax filings or corporate financial reports.

Step 5: Save, Preview, or Send

Once your message is ready, you have several options:

- Save as Draft: If you’re not ready, save the message and return later.

- Preview: Review your message and attachments before sending. Make sure all documents are correct, and redactions are applied.

- Send Message: Deliver the secure message immediately.

Your client will receive a professional email with a secure link. When they click it, they can access the message and download files safely — without ever receiving email attachments.

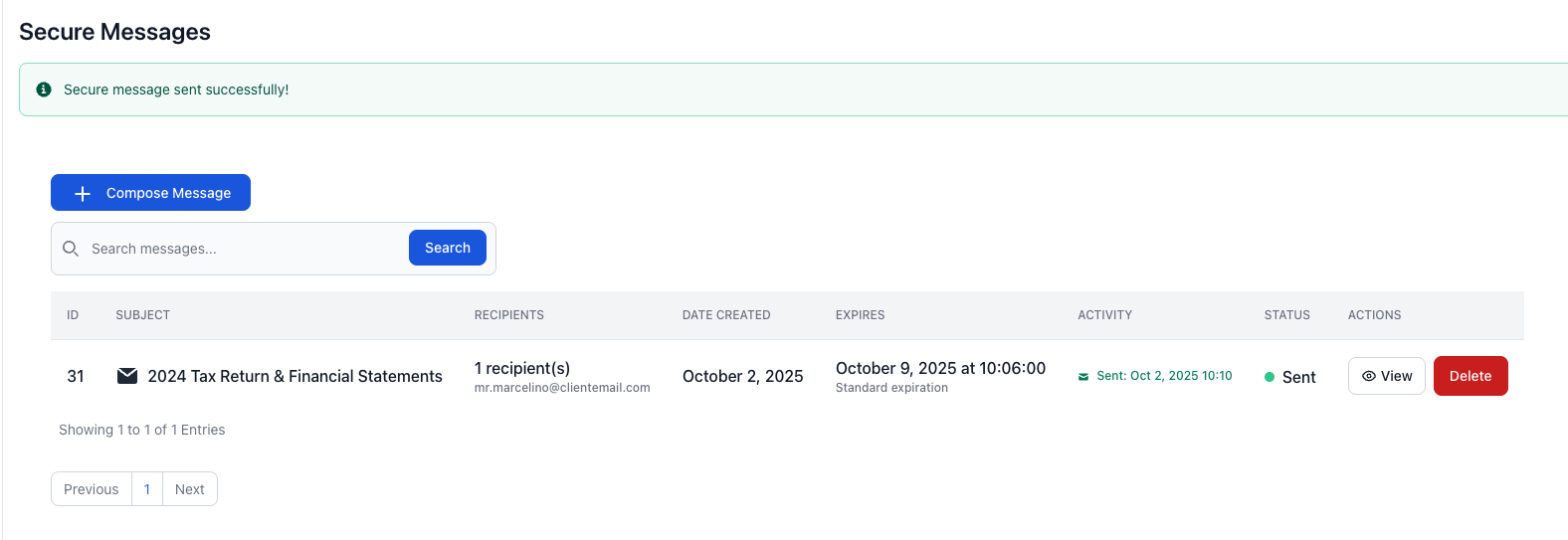

Step 6: Track and Audit

After sending:

- Monitor timestamps showing when the client opened the message and downloaded files.

- Export transfer logs for recordkeeping and compliance purposes.

- Review “Most Active Messages” or “Expiring Soon” dashboards to proactively manage outstanding downloads.

Real-World Tip: For accountants delivering end-of-year tax filings, exporting logs ensures you have proof of delivery for IRS, audit, or internal compliance purposes.

Why Secure Send Matters for Accounting Firms

Secure Send helps accountants and finance professionals:

- Protect client confidentiality by removing risky email attachments.

- Stay compliant with data privacy standards.

- Maintain professionalism with branded secure messages.

- Control access with expiration dates and one-time download options.

By using FileDrop, your firm reduces risk while streamlining secure financial document delivery.

Real-World Example: Sending Tax Returns to a Client

Imagine you’ve prepared Mr. Marcelino’s 2024 tax return and financial statements:

- Upload 1040 tax return, income statement, balance sheet, and supporting schedules.

- Set the message: “Please download your 2024 tax return and financial statements. This link will expire in 7 days.”

- Enable expire after first download.

- The client clicks the link, downloads the files, and you see a timestamp confirming access.

- Export the transfer log for compliance and recordkeeping.

Result: Secure, traceable, and professional delivery — no insecure email attachments involved.

Best Practices for Accountants Using Secure Send

- Verify client email addresses before sending.

- Use clear subject lines tied to tax years or reporting periods.

- Keep sensitive details inside the secure message, not the notification email.

- Redact confidential information before sending.

- Log every transfer for audit and compliance purposes.

- Train staff to follow a consistent workflow for secure document delivery.

Conclusion: Fast, Secure, and Professional Financial Document Delivery

Email attachments are outdated and risky. With Secure Send, accounting firms can deliver tax returns, financial statements, and other client documents securely, efficiently, and professionally. Control access, enforce expiry, track downloads, and maintain compliance — all while improving client trust.

Ready to send tax returns and financial statements securely? Get started with FileDrop today.

Frequently Asked Questions (FAQs)

Do my clients need a FileDrop account?

No. Clients click the secure link — no account or login required.

What if I send the wrong file?

If the client hasn’t downloaded it, you can shorten or cancel the expiry period to revoke access.

Can I track when a client downloads a file?

Yes. Secure Send provides timestamps showing when the message was read and files were downloaded.

How big of a file can I send?

You can send up to 100 files per transfer, each up to 1 GB.

The Bottom Line:

One keeps you awake. The other gets work done.

A month of coffee: $150

A month of FileDrop: $19

Why not have both?