Managing debt can feel overwhelming, but a simple Google Sheets template can help you keep track of your progress and stay on top of your payments. In this guide, I’ll show you how to create a personalized debt reduction template that helps you organize your debts and plan your way to financial freedom.

Why Is Debt Reduction Tracker Important?

A debt reduction tracker is important because it provides a clear outline and visualization of your financial obligations, helping you stay organized and focused on achieving your debt-free goal.

It lets you pinpoint how much you owe, your progress on payments, and the interest rates you’re dealing with, which informs better decisions on which debts to prioritize based on their sizes or costs.

Step 1: Open a New Google Sheet

Go to Google Sheets and click “+ Blank” to open a new spreadsheet. Once there, rename the file by clicking “Untitled Spreadsheet” for proper organization. Here, I’ll use “Debt Management.”

Step 2: Set Up the Headings

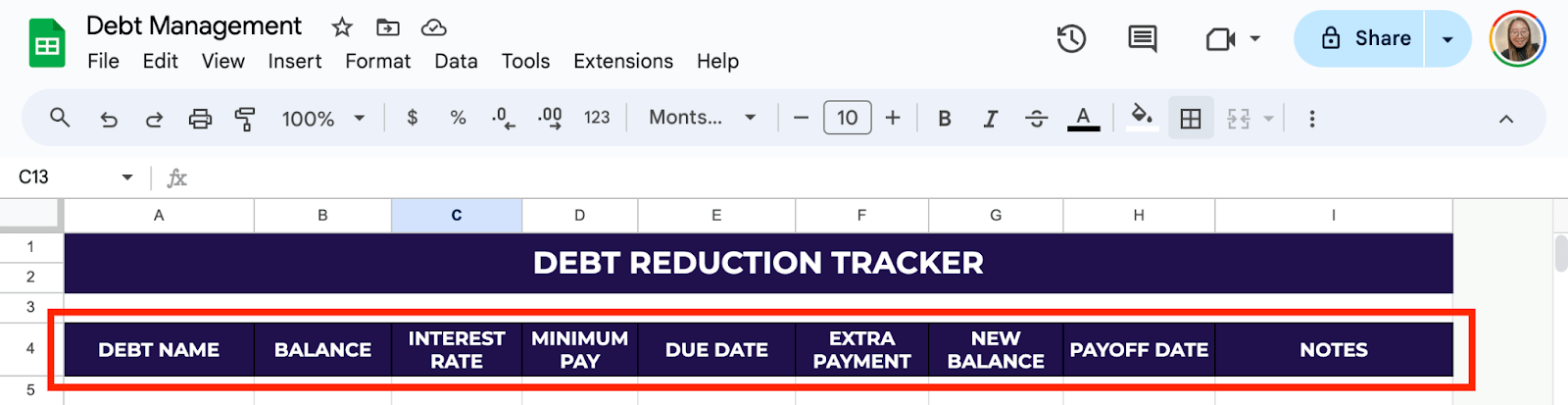

At the top of your sheet, you’ll need headings to organize your information. Type the following headings in each column:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Due Date

- Payoff Date

These headings will make it easy to track all the important details of each debt.

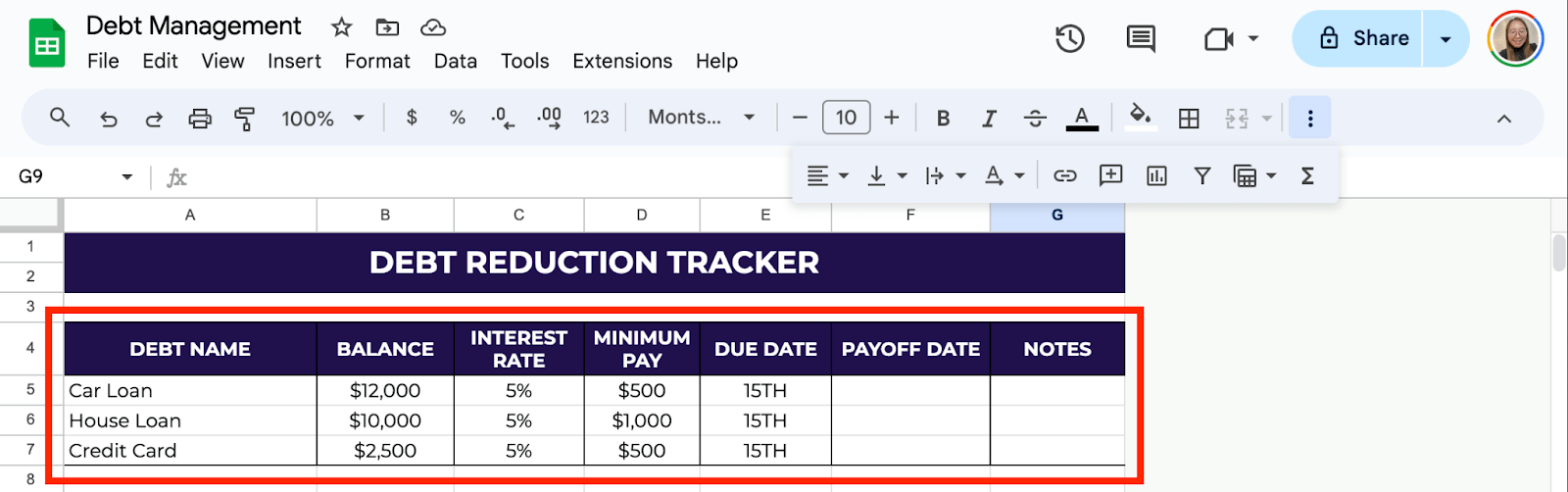

Step 3: List Your Debts

In the rows below your headings, list each of your debts individually. For example, if you have a student loan, a car loan, and two credit cards, enter each one in its own row under “Debt Name.” Enter the corresponding balance, interest rate, minimum payment, and due date for each debt.

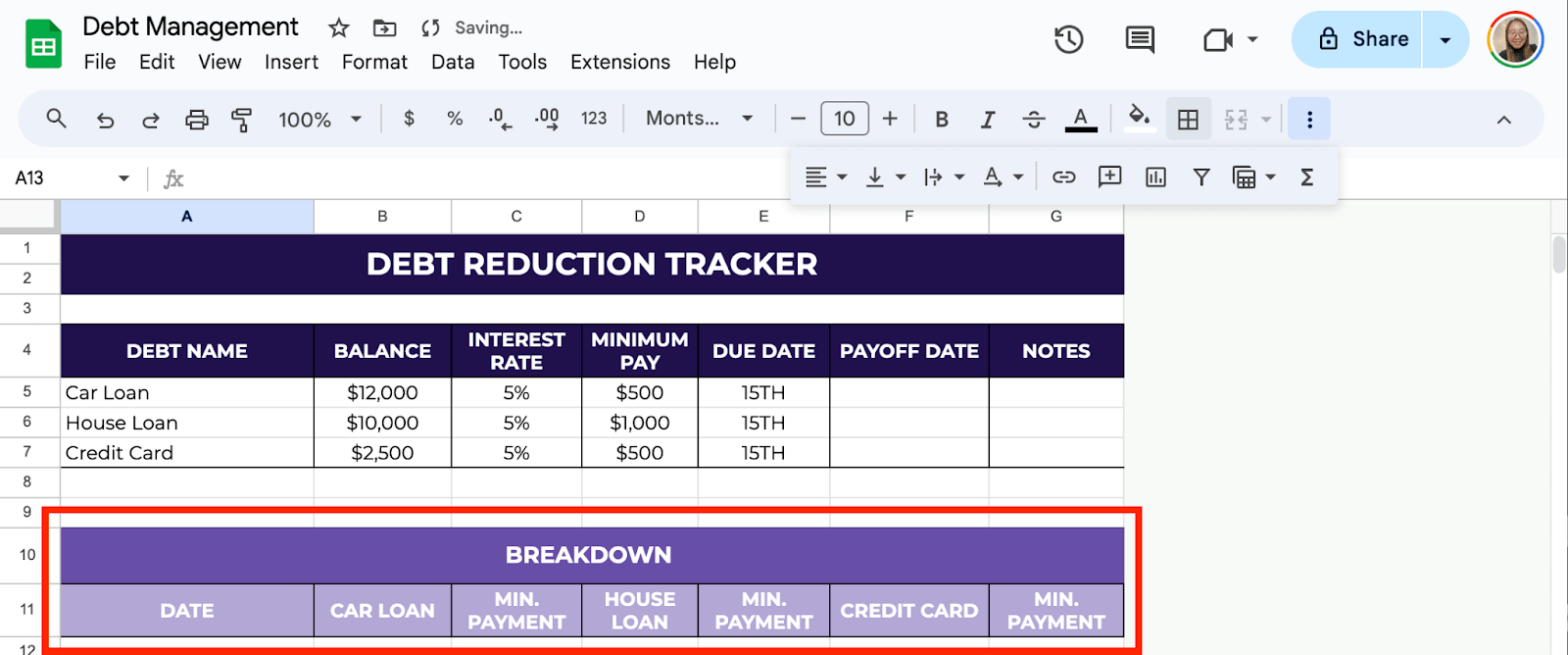

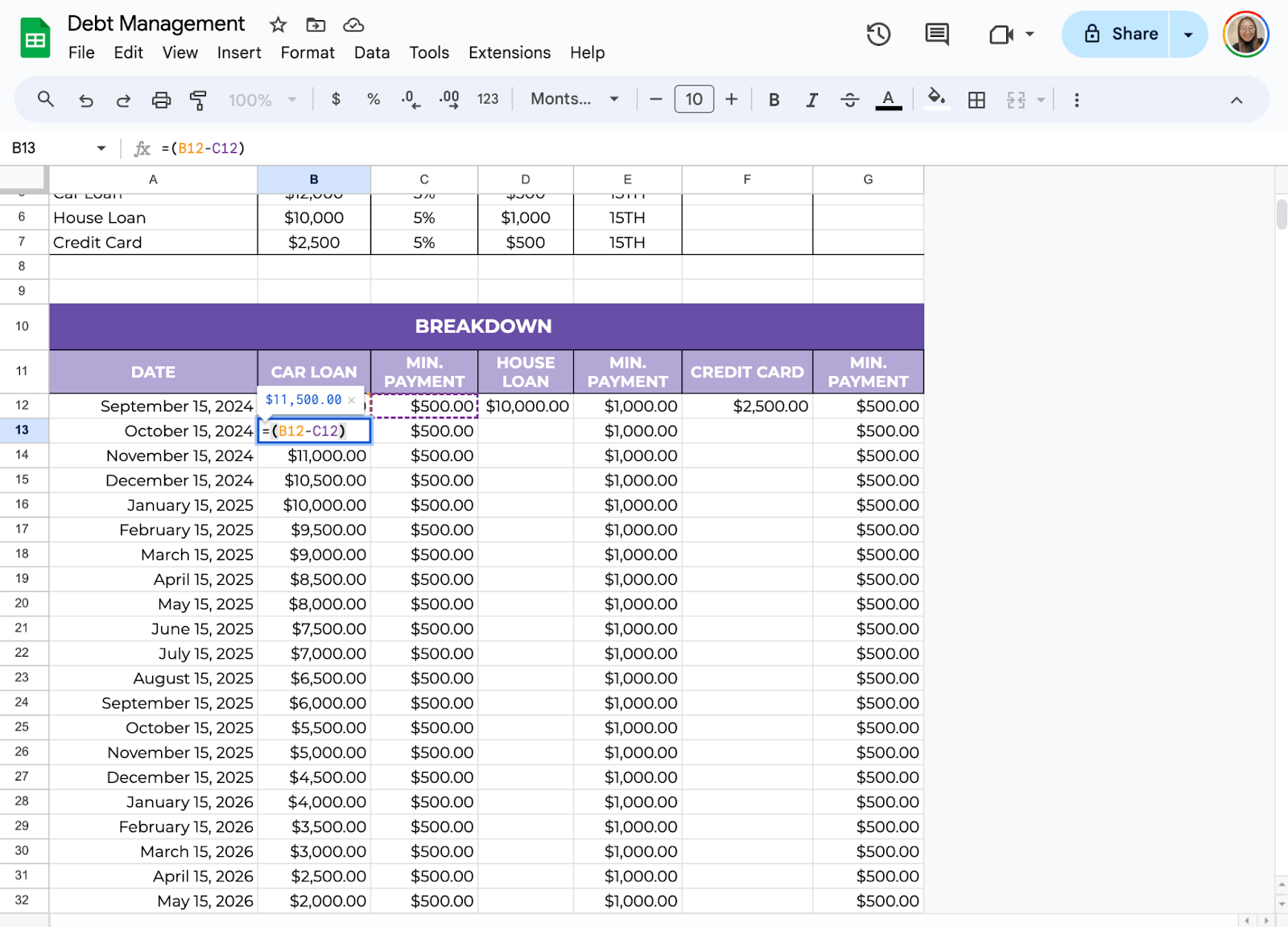

Step 4: Add a Breakdown Summary

Under your primary table, you can add a debt reduction breakdown to see the progress of your debt repayment. You can use labels, such as dates, debt names, and minimum payments.

Step 5: Enter the Breakdown Information

Fill in the Breakdown table with the repayment dates and other necessary information.

Step 6: Add Formulas for Calculating Payments

Let’s set up a few simple formulas to make the sheet do the math for you.

Calculate the Running Balance

Under the loan balance heading, use the formula =(B12-C12) (assuming that B12 is the loan and C12 is the minimum payment.

Now, the sheet will automatically calculate your new balance after each payment. Repeat this formula for every debt by dragging the formula down the column.

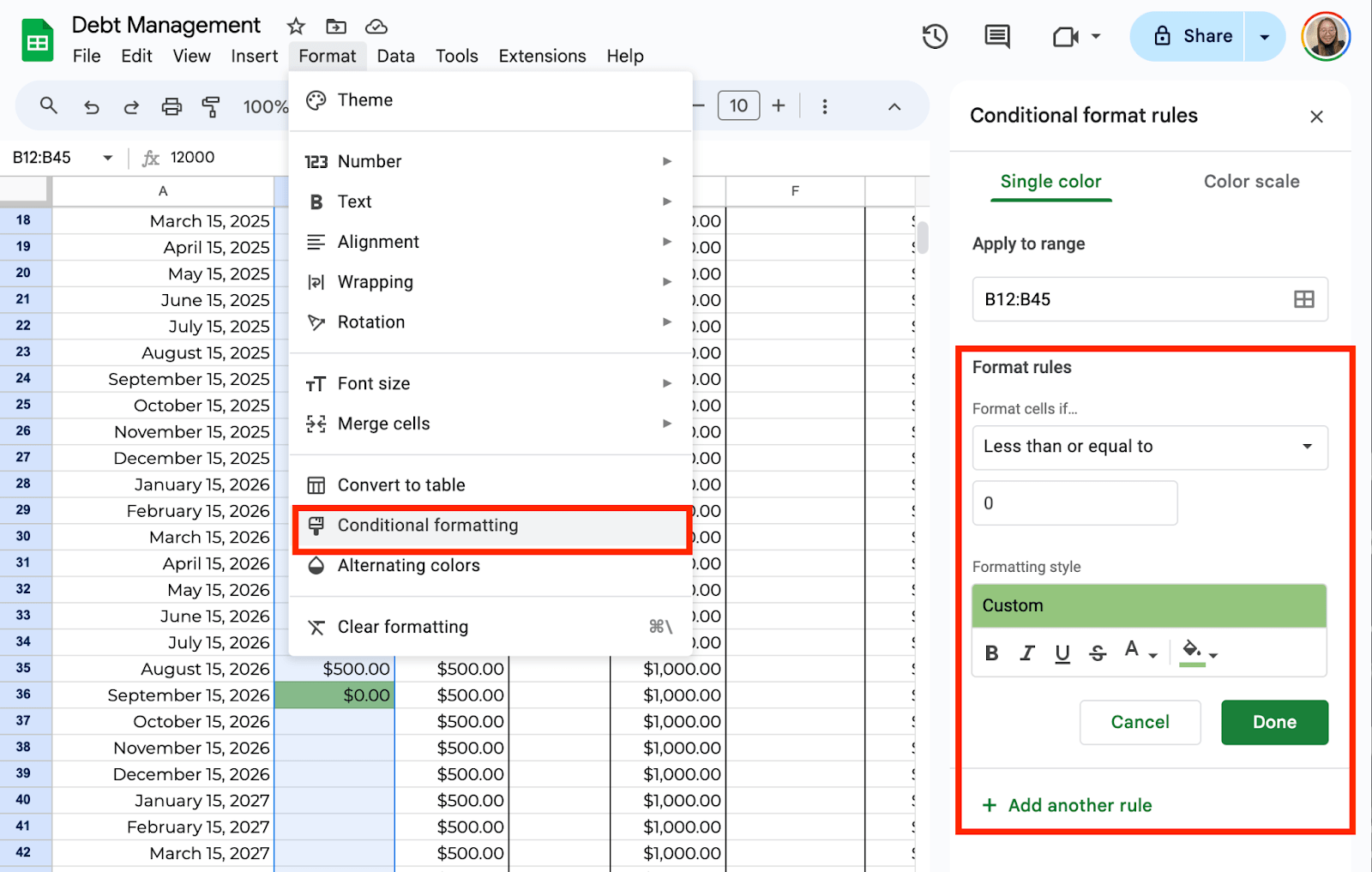

Step 7: Use Conditional Formatting

To easily see which payments are paid off, you can set up color-coded formatting. Select the cells in the loan balance column. Go to Format > Conditional Formatting. Under Format cells if, choose Less than or equal to, then enter the value 0.

Get the Free Debt Reduction Template

Get a copy of the free Debt Reduction template. I’ve populated some cells as examples, but you can customize them as needed.

Final Thoughts

With this simple debt reduction template, you can stay organized and motivated as you work toward becoming debt-free. It’s easy to customize based on your needs and can be updated as your financial situation changes. Breaking down your debt into manageable steps and tracking your progress can help you feel more in control of your finances.

Frequently Asked Questions

How can I calculate the remaining balance of my debt in Google Sheets?

You can calculate the remaining balance of each debt by using a simple formula. For example =Initial Debt – Payments Made. This formula will show how much you still owe after each payment.

How do I prioritize debt payments in the template?

You can use Google Sheets’ SORT feature to arrange your debts by interest rate, remaining balance, or monthly payment. This makes it easier to decide which debts to pay off first, based on your chosen strategy.

Can I create charts to visualize my debt reduction?

Google Sheets allows you to create charts that visually represent your debt reduction. Use a line chart or bar chart to track balances over time. Select your data, click Insert > Chart, and customize it to display total debt reduction or individual debt progress.

The Bottom Line:

One keeps you awake. The other gets work done.

A month of coffee: $150

A month of FileDrop: $19

Why not have both?